(We originally posted this in 2021. You can read more of our original ideas in our archive. You can order a business plan of this idea here.)

Problem: The hardest hit real estate market due to COVID19 is commercial real estate: my hunch is that this downturn will continue to persist, especially as more companies allow employees to work from home permanently.

Solution: This business would take existing commercial real estate and make it more flexible during this strange time (i.e. during COVID19) by transitioning what used to be commercial properties into rental/personal properties that people can live in or work in as an “office away from home.”

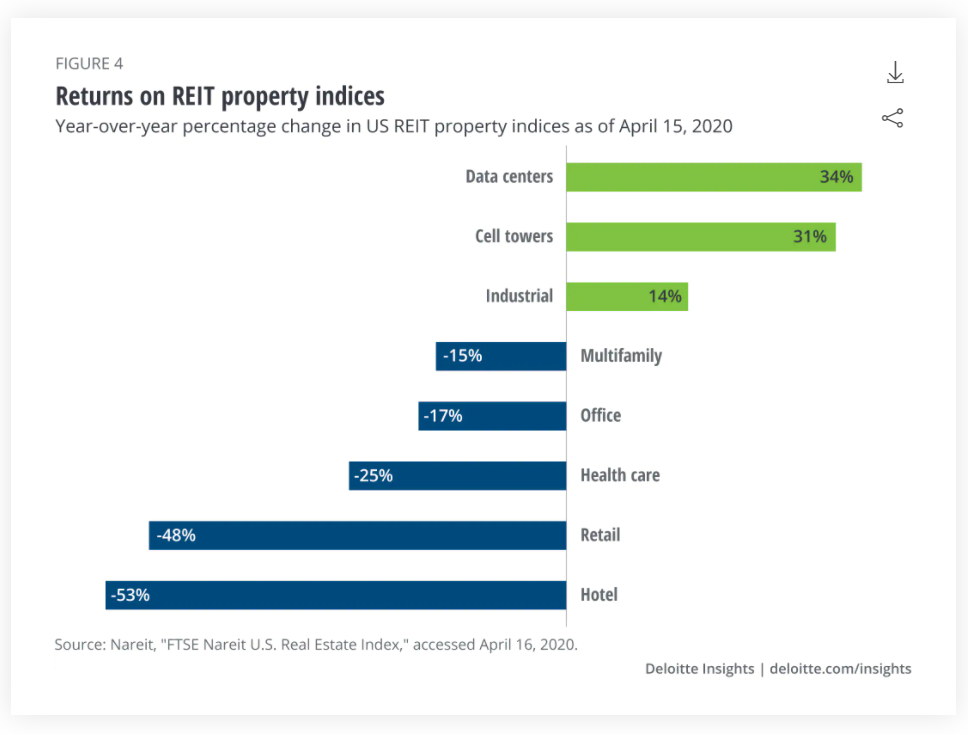

Deloitte wrote a phenomenal report on this and a few of their images and highlights are below:

Since the second week of March, when COVID-19 was declared a pandemic, spreading globally and, particularly, across the United States, financial markets have declined sharply. The S&P 500 and Russel 2000 declined by 13 percent and 29 percent year to date as of April 15. The US 10-year treasury yields declined by 127 bps to 0.6 percent over the same time period.

Rather than the typical lag, the CRE industry was affected immediately. This was because trade activities and occupiers’ businesses were shut down.

Biz Jorunal also published a great dialogue where they “spoke with three experts with SunTrust Bank, which has merged with BB&T to become Truist: Head of National Real Estate Adam Oates, Head of Real Estate Corporate & Investment Banking Kris Dickson, and Head of Truist Community Capital (TCC) Keitt King for their perspectives on where the market is headed next.” Their responses are below as well.

Q: What's different about how the current financial recession is impacting commercial real estate compared to the 2008 recession? Is anything similar?

Oates: One thing I would highlight is the suddenness and severity to this particular downturn. When you look at a sector like hospitality, which has been hit maybe the hardest and fastest, you went from full occupancy to single digits in a matter of weeks. There's just no blueprint for that.

Dickson: The root cause of this pullback is clearly very different than what we experienced in 2008. Further, the pace and volume of Covid stimulus activity by policymakers have been significant, and we’re not faced with the supply headwinds from new construction stock that we had in 2008. So this recovery should be quicker, though some of that's obviously predicated upon the timing of a coronavirus vaccine and keeping us from having a resurgence of Covid cases. Similar to the prior downturn, we'll likely see downward pressure on values and occupancy levels for most CRE property types. Overall, this shouldn't be to the same order of magnitude as the prior recession, as a result of getting the economy back on track sooner; however, there will be dispersion across asset classes, and it's not going to be an overnight recovery by any stretch.

King: I come from the affordable housing angle, a very specific subset of CRE. When I think about the last recession, one thing that's the same is our business is really driven by corporate earnings and associated tax liability. In 2008, as the recession continued, we saw the overall tax liability shrink. While a similar trend is happening now, it's very hard to project the length of this downturn as a health crisis of this magnitude. And its impact on the economy and overall earnings is such an unknown. You're seeing the market for tax credits start to pull back because of the belief that taxable income is going to come down over time. We just don't have a good sense of how much.

Ultimately, this business would create a new business model to thrive in this market of uncertainty: perhaps monetizing on collections made rather than on occupancy and rent. Nareit estimates that the 2018 total dollar value of commercial real estate was between $14 and $17 trillion, with a mid-point of $16 trillion. Even a slice if this market in one city would be a significant amount of business.

Monetization: Innovations on the business model to go “beyond rental income”

Contributed by: Michael Bervell (Billion Dollar Startup Ideas)